38 yield of zero coupon bond

Yield from Government 10 bonds UK 2022 | Statista Average yield from 10 year UK government bonds 2010-2022. The monthly average yield on 10 year nominal zero coupon British Government Securities in the United Kingdom (UK) has seen a continued ... United States Government Bonds - Yields Curve The United States 10Y Government Bond has a 2.954% yield.. 10 Years vs 2 Years bond spread is -19.8 bp. Yield Curve is inverted in Long-Term vs Short-Term Maturities. Central Bank Rate is 1.75% (last modification in June 2022).. The United States credit rating is AA+, according to Standard & Poor's agency.. Current 5-Years Credit Default Swap quotation is 21.00 and implied probability of ...

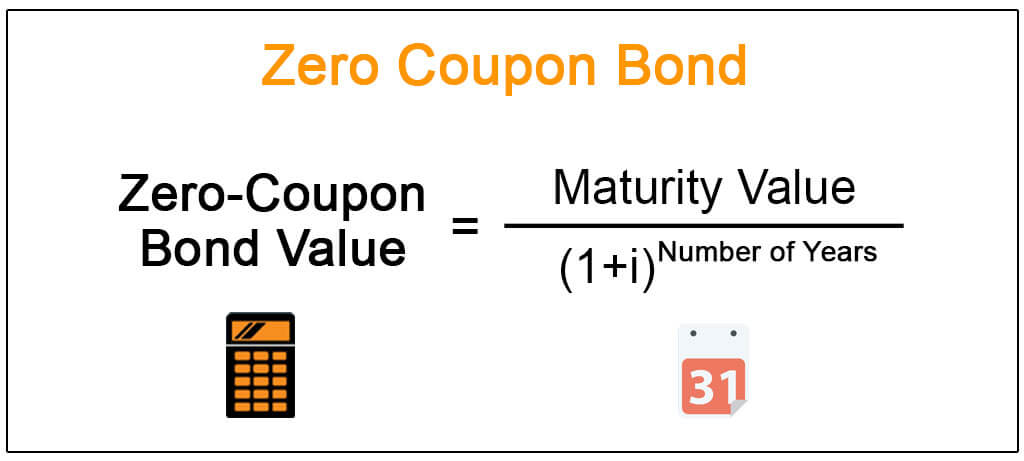

Price of a Zero coupon bond - Calculator - Finance pointers The Price of a zero coupon bond is calculated using the following formula : = FV / ( 1 + r ) n. Where. P = Price of a zero coupon bond ; FV = Face value / Maturity value of the zero coupon bond ; r = Discount rate ; n = Term to maturity ; In the calculator below insert the values of Face value / Maturity value of the zero coupon bond, Discount ...

/97615498-56a6941c3df78cf7728f1cd4.jpg)

Yield of zero coupon bond

South Africa Government Bonds - Yields Curve Yield Bond Price - with different Coupon Rates Fx; 0% 1% 3% 5% 7% 9%; 30 years: 11.865%: 3.46: 11.60: 27.87: 44.14: 60.42: 76.69: 25 years: 11.920%: 5.99: 13.88: 29.65: 45.42: 61.20: 76.97: 20 years: 11.930%: 10.50: 18.00: 33.00: 48.01: 63.01: 78.02: 12 years: 11.485%: 27.13: 33.47: 46.16: 58.85: 71.54: 84.23: 10 years: 11.045%: 35.08: 40.95: 52.71: 64.47: 76.22: 87.98: 5 years: 9.505%: 63.51: 67.35: 75.03: 82.70: 90.38: 98.06: 2 years: 6.780%: 87.70: 89.52 Zero Coupon Bond: Formula & Examples - Study.com The target purchase price of a zero coupon bond, assuming a desired yield, can be calculated using the present value (PV) formula: price = M / (1 + i)^n. US Treasury Zero-Coupon Yield Curve - Nasdaq Data Link US Treasury Zero-Coupon Yield Curve. Description These yield curves are an off-the-run Treasury yield curve based on a large set of outstanding Treasury notes and bonds, and are based on a...

Yield of zero coupon bond. Understanding Zero Coupon Bonds - Part One - The Balance Zero coupon bonds generally come in maturities from one to 40 years. The U.S. Treasury issues range from six months to 30 years and are the most popular ones, along with municipalities and corporations. 1. Here are some general characteristics of zero coupon bonds: You must pay tax on interest annually even though you don't receive it until ... Fitted Yield on a 2 Year Zero Coupon Bond (THREEFY2) Fitted Yield on a 2 Year Zero Coupon Bond. (THREEFY2) Observation: 2022-07-15: 3.2558 (+ more) Updated: Jul 19, 2022. 2022-07-15: 3.2558. 2022-07-14: 3.2658. Calculating the Effective Yield of a Zero-Coupon Bond To calculate the return for a zero-coupon bond, the following zero-coupon bond effective yield formula is applied: [ {F/PV}]^ (1/t) =1+r Where F -face value of the bond PV- current value of the bond t -time to maturity r- Interest rate For example, an investor purchases a zero-coupon bond at $ 200, which has a face value at maturity of $400. How to Calculate Yield to Maturity of a Zero-Coupon Bond Zero-Coupon Bond Formula The formula for calculating the yield to maturity on a zero-coupon bond is: Yield To Maturity= (Face Value/Current Bond Price)^ (1/Years To Maturity)−1 Zero-Coupon Bond YTM...

United Kingdom Government Bonds - Yields Curve The United Kingdom 10Y Government Bond has a 2.159% yield.. 10 Years vs 2 Years bond spread is 19.2 bp. Yield Curve is flat in Long-Term vs Short-Term Maturities. Central Bank Rate is 1.25% (last modification in June 2022).. The United Kingdom credit rating is AA, according to Standard & Poor's agency.. Current 5-Years Credit Default Swap quotation is 18.00 and implied probability of default ... Philippines Government Bonds - Yields Curve The Philippines 10Y Government Bond has a 6.962% yield.. 10 Years vs 2 Years bond spread is 249.9 bp. Normal Convexity in Long-Term vs Short-Term Maturities. Central Bank Rate is 3.25% (last modification in July 2022).. The Philippines credit rating is BBB+, according to Standard & Poor's agency.. Current 5-Years Credit Default Swap quotation is 57.35 and implied probability of default is 0.96%. What Is a Zero-Coupon Bond? Definition, Characteristics & Example So, where a normal bond's yield is the total value of all of its interest payments, a zero-coupon bond's yield is its imputed interest, or the amount by which its face value was discounted when it... Advantages and Risks of Zero Coupon Treasury Bonds Unique Risks of Zero-Coupon U.S. Treasury Bonds. Because of their sensitivity to interest rates, zero-coupon Treasury bonds have incredibly high interest rate risk. Treasury zeros fall ...

Zero-Coupon Bond Definition - Investopedia The interest earned on a zero-coupon bond is an imputed interest, meaning that it is an estimated interest rate for the bond and not an established interest rate. For example, a bond with a face... Fitted Yield on a 10 Year Zero Coupon Bond (THREEFY10) Fitted Yield on a 10 Year Zero Coupon Bond. (THREEFY10) Observation: Q4 2016: 2,584,419,873,000 (+ more) Updated: Feb 26, 2018. Q4 2016: 2,584,419,873,000. Q3 2016: 2,580,220,049,000. Estimate yield of coupon bond given yield of zero coupon bond Then, determining the yield of a bond its just a matter of solving 0 = V q u o t e d − ∑ i = 1 N C i ( 1 + y) t i. If both bonds, the one with zero coupons and the one with coupons trade at the same price V, then the one with coupons will have a higher yield. Note that the yield is a way of measuring cost-effectiveness. Fitted Yield on a 1 Year Zero Coupon Bond (THREEFY1) Fitted Yield on a 1 Year Zero Coupon Bond. (THREEFY1) Observation: 2022-07-08: 2.8635 (+ more) Updated: Jul 12, 2022. 2022-07-08: 2.8635. 2022-07-07: 2.7997.

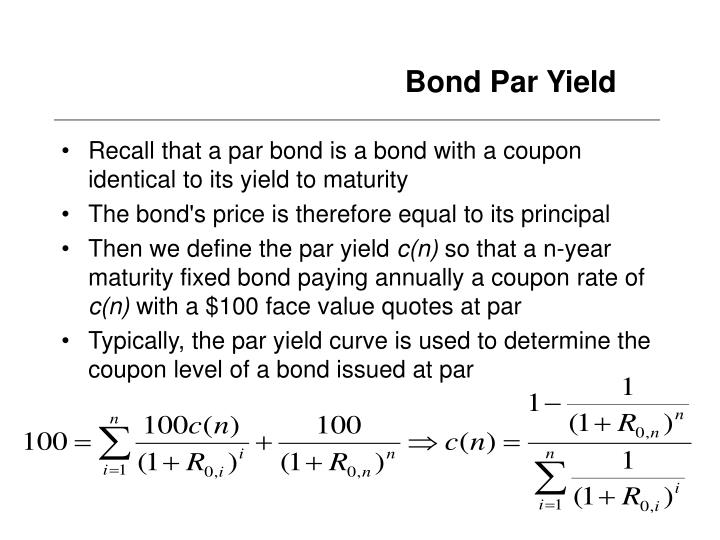

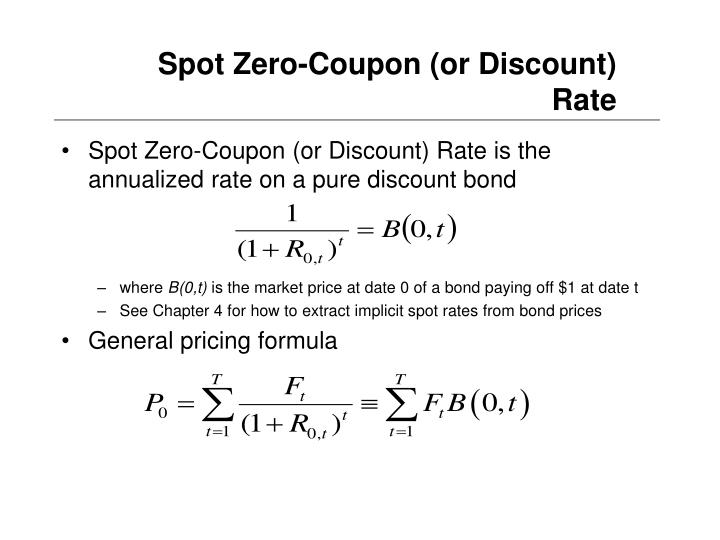

How do you construct a zero coupon curve from the current market yield ... The yields at a tenor of 0.5 years calculated above is a zero-coupon rate and your starting point for bootstrapping the zero-coupon curve. We then use bootstrapping to construct the zero/spot curve. We use the interpolated yield for each tenor as the ANNUAL COUPON which defines the cash flows before maturity.

How do I Calculate Zero Coupon Bond Yield? (with picture) Even the calculators that find yield to maturity use this method; they simply iterate it. The zero coupon bond yield is easier to calculate because there are fewer components in the present value equation. It is given by Price = (Face value)/ (1 + y) n, where n is the number of periods before the bond matures.

Effective Yield - Overview, Formula, Example, and Bond Equivalent Yield The formula for calculating the effective yield on a bond purchased: Effective Yield = [1 + (i/n)] n - 1. Where: i - The nominal interest rate on the bond; n - The number of coupon payments received in each year; Practical Example. Assume that you purchase a bond with a nominal coupon rate of 7%.

What Is the Coupon Rate of a Bond? - The Balance A coupon rate is the annual amount of interest paid by the bond stated in dollars, divided by the par or face value. For example, a bond that pays $30 in annual interest with a par value of $1,000 would have a coupon rate of 3%. Regardless of the direction of interest rates and their impact on the price of the bond, the coupon rate and the ...

› Zero-Coupon-BondZero Coupon Bond Yield - Formula (with Calculator) The zero coupon bond effective yield formula shown up top takes into consideration the effect of compounding. For example, suppose that a discount bond has five years until maturity. If the number of years is used for n, then the annual yield is calculated. Considering that multiple years are involved, calculating a rate that takes time value of money and compounding into consideration is needed. An investment that pays 10% per year is not equivalent to a 10 year discount bond that pays a ...

What Is a Zero Coupon Yield Curve? (with picture) The price of a bond at any particular time depends on the market conditions, including the expectations of the market in respect of the future movements in interest rates. The zero coupon rate is the return, or yield, on a bond corresponding to a single cash payment at a particular time in the future. This would represent the return on an investment in a zero coupon bond with a particular time to maturity.

› glossary › zero-coupon-bondZero Coupon Bond | Investor.gov Zero Coupon Bond. Zero coupon bonds are bonds that do not pay interest during the life of the bonds. Instead, investors buy zero coupon bonds at a deep discount from their face value, which is the amount the investor will receive when the bond "matures" or comes due. The maturity dates on zero coupon bonds are usually long-term—many don’t ...

Fitted Yield on a 5 Year Zero Coupon Bond (THREEFY5) Graph and download economic data for Fitted Yield on a 5 Year Zero Coupon Bond (THREEFY5) from 1990-01-02 to 2022-07-08 about 5-year, bonds, yield, interest rate, interest, rate, and USA.

Zero-Coupon Convertible - Investopedia Zero-Coupon Convertible: A fixed income instrument that is a combination of a zero-coupon bond and a convertible bond. Due to the zero-coupon feature, the bond pays no interest and is issued at a ...

Zero-Coupon Bond - Definition, How It Works, Formula Example of a Zero-Coupon Bonds Example 1: Annual Compounding. John is looking to purchase a zero-coupon bond with a face value of $1,000 and 5 years to maturity. The interest rate on the bond is 5% compounded annually. What price will John pay for the bond today? 5 = $783.53. The price that John will pay for the bond today is $783.53.

India Government Bonds - Yields Curve The India 10Y Government Bond has a 7.438% yield. 10 Years vs 2 Years bond spread is 102.7 bp. ... The highlighted column refers to the zero coupon bond. Click on for a forecast of the yield. If data are not all visible, swipe table left. Residual Maturity Yield Bond Price - with different Coupon Rates Fx; 0% 1% 3% 5% 7% 9%;

How Can a Bond Have a Negative Yield? - Investopedia In this scenario, the bond table will show that the bond will have a YTM of about 10.86%. If the bondholder had paid $1,200 for the bond, the YTM would be about -9.41%. Keep in mind, though, that a...

US Treasury Zero-Coupon Yield Curve - Nasdaq Data Link US Treasury Zero-Coupon Yield Curve. Description These yield curves are an off-the-run Treasury yield curve based on a large set of outstanding Treasury notes and bonds, and are based on a...

Zero Coupon Bond: Formula & Examples - Study.com The target purchase price of a zero coupon bond, assuming a desired yield, can be calculated using the present value (PV) formula: price = M / (1 + i)^n.

South Africa Government Bonds - Yields Curve Yield Bond Price - with different Coupon Rates Fx; 0% 1% 3% 5% 7% 9%; 30 years: 11.865%: 3.46: 11.60: 27.87: 44.14: 60.42: 76.69: 25 years: 11.920%: 5.99: 13.88: 29.65: 45.42: 61.20: 76.97: 20 years: 11.930%: 10.50: 18.00: 33.00: 48.01: 63.01: 78.02: 12 years: 11.485%: 27.13: 33.47: 46.16: 58.85: 71.54: 84.23: 10 years: 11.045%: 35.08: 40.95: 52.71: 64.47: 76.22: 87.98: 5 years: 9.505%: 63.51: 67.35: 75.03: 82.70: 90.38: 98.06: 2 years: 6.780%: 87.70: 89.52

Post a Comment for "38 yield of zero coupon bond"