38 zero coupon convertible bond

Duration and convexity of zero-coupon convertible bonds The zero-coupon convertible bond has face value, F2, and also matures at t = T. The convertible holders have the option to convert the bonds to equity at ... Zero coupon convertibles do not have a zero cost May 11, 2021 ... Convertible bond issuance is at a record high, with companies 'benefiting' from low interest rates and high equity volatility.

500,000,000 Zero Coupon Senior Unsecured Convertible Bond due ... €500,000,000 Zero-Coupon Senior Unsecured Convertible Bond due 2013 (the “Bond”). THE SECURITIES REPRESENTED HEREBY HAVE NOT BEEN REGISTERED UNDER THE ...

Zero coupon convertible bond

Record Run for Zero-Interest Convertible Bonds Hits a Wall - WSJ Feb 4, 2022 ... Investors gobbled up convertible bonds with zero coupon from companies including Airbnb, SoFi, Snap, Ford, DraftKings, Twitter, Shake Shack, ... £350m Zero Coupon Guaranteed Convertible Bonds due 2020 On 9 June 2015, the Group issued £350m Zero Coupon Guaranteed Convertible Bonds due 2020. Zero Coupon Convertible Debenture Law and Legal Definition Zero Coupon Convertible Debenture/security is a zero coupon bond that is convertible into the common stock of the issuing company after the common stock ...

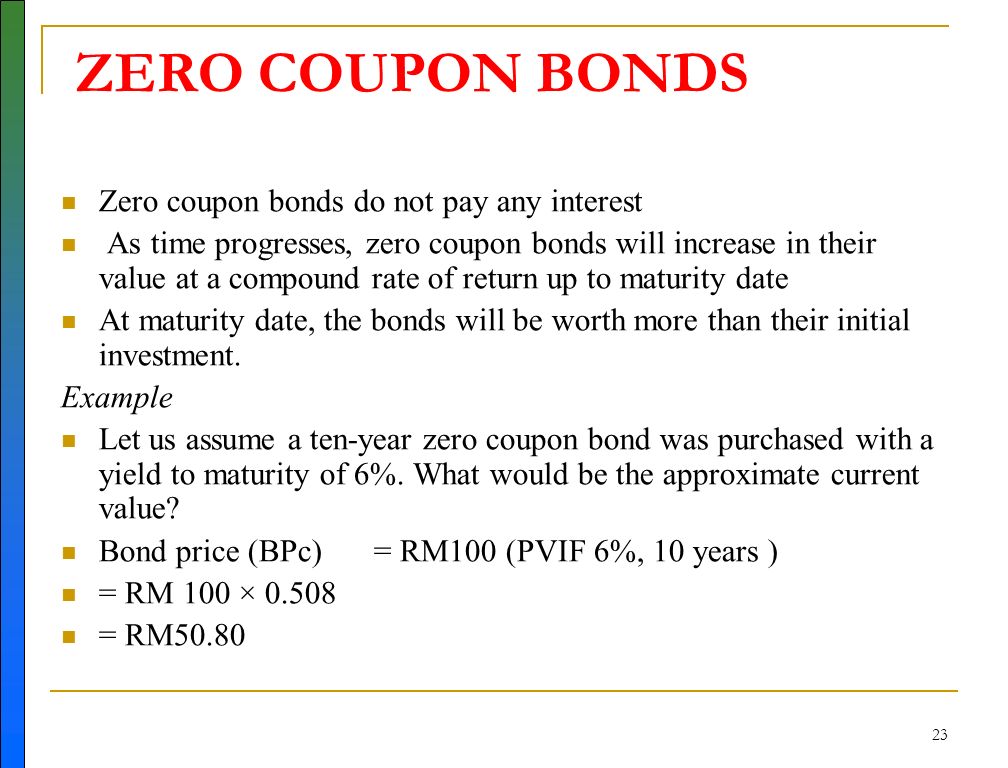

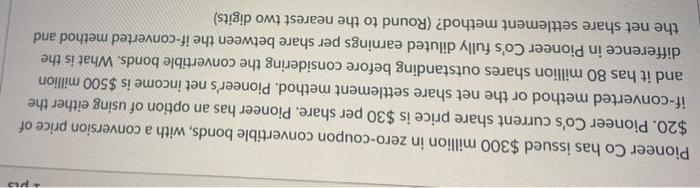

Zero coupon convertible bond. Zero-Coupon Convertible - Investopedia Due to the zero-coupon feature, the bond pays no interest and is therefore issued at a discount to par value, while the convertible feature means that ... Zero-coupon convertible bond - Financial Dictionary 1. A bond that may be converted into common stock in the company issuing it. A zero-coupon convertible bond is sold at a discount from par and matures ... INT 02-05: Accounting for Zero Coupon Convertible Bonds - NAIC The following is another example of a convertible bond, but the coupon rate is zero and the purchase price is at a premium (above par value). Thus, the insurer ... Zero-coupon convertible bonds - YieldCurve.com Zero-coupon convertible bonds or “optional convertible notes” (OCNs) are well- established in the market. When they are issued at a discount to par, ...

Zero Coupon Convertible Debenture Law and Legal Definition Zero Coupon Convertible Debenture/security is a zero coupon bond that is convertible into the common stock of the issuing company after the common stock ... £350m Zero Coupon Guaranteed Convertible Bonds due 2020 On 9 June 2015, the Group issued £350m Zero Coupon Guaranteed Convertible Bonds due 2020. Record Run for Zero-Interest Convertible Bonds Hits a Wall - WSJ Feb 4, 2022 ... Investors gobbled up convertible bonds with zero coupon from companies including Airbnb, SoFi, Snap, Ford, DraftKings, Twitter, Shake Shack, ...

/ConvertibleBondsPrice2-2285ff1211c545be919565380a232a02.png)

![PDF] Duration and convexity of zero-coupon convertible bonds ...](https://d3i71xaburhd42.cloudfront.net/39b5487ce4f8becdfb0faf5ae6e30fd10537436c/14-Figure6-1.png)

:max_bytes(150000):strip_icc()/zero-couponbond_final-a6ec3618516a49c9a3654a1c79c9b681.png)

Post a Comment for "38 zero coupon convertible bond"