42 perpetual zero coupon bond

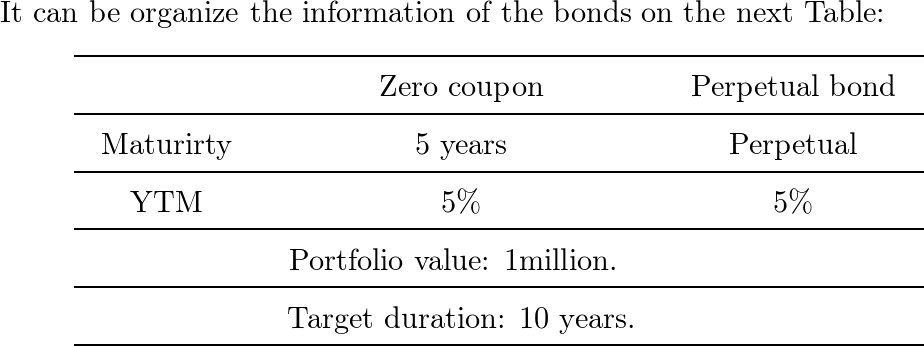

Zero-Coupon Inflation-Indexed Swap - Wikipedia The Zero-Coupon Inflation Swap (ZCIS) is a standard derivative product which payoff depends on the Inflation rate realized over a given period of time. The underlying asset is a single Consumer price index (CPI). It is called Zero-Coupon because there is only one cash flow at the maturity of the swap, without any intermediate coupon. Domestic bonds: DOF Subsea, 0% perp., USD NO0010955867 Issue Information Domestic bonds DOF Subsea, 0% perp., USD. Issue, Issuer, Yield, Prices, Payments, Analytical Comments, Ratings

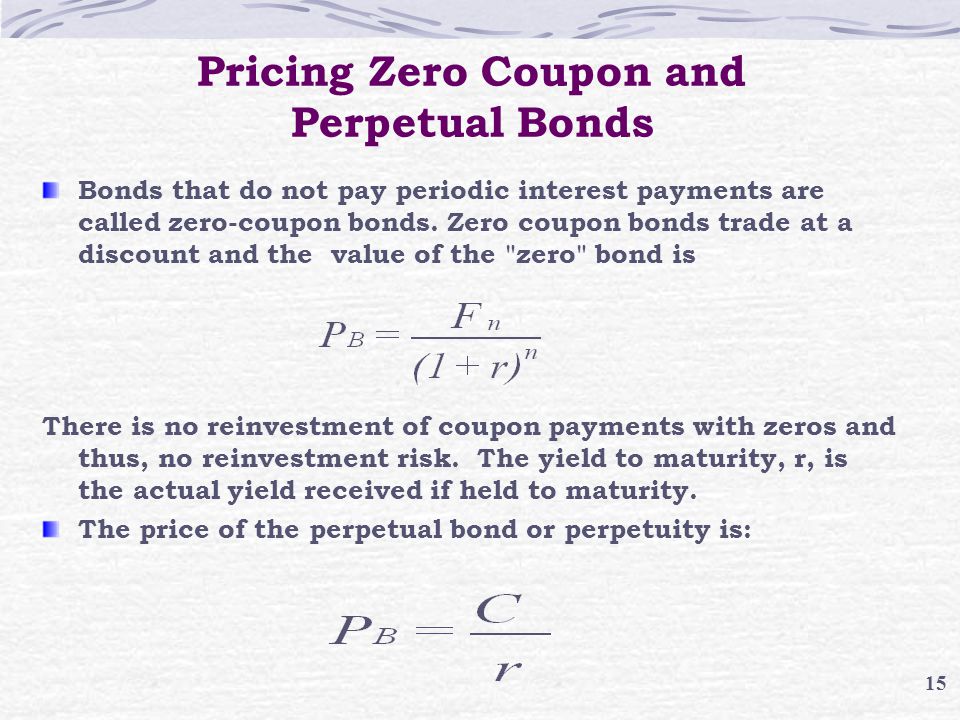

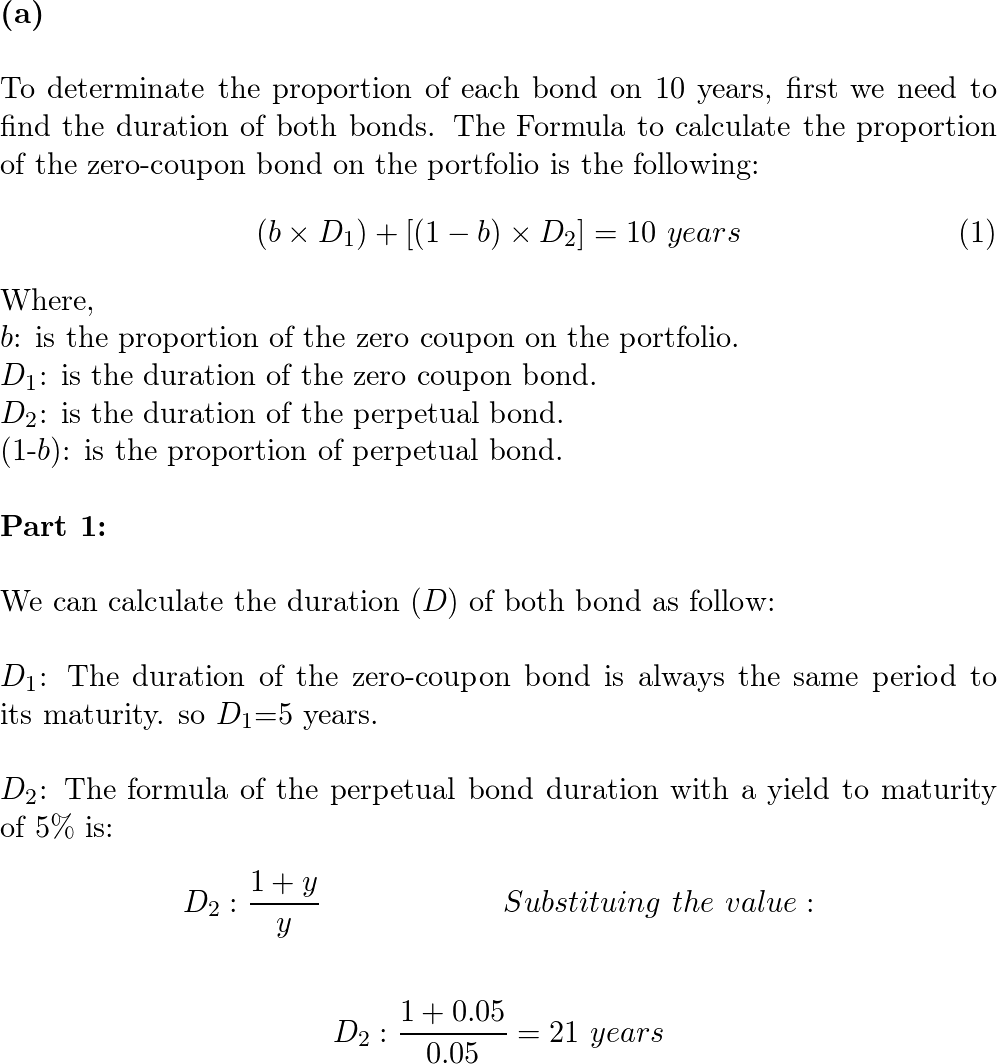

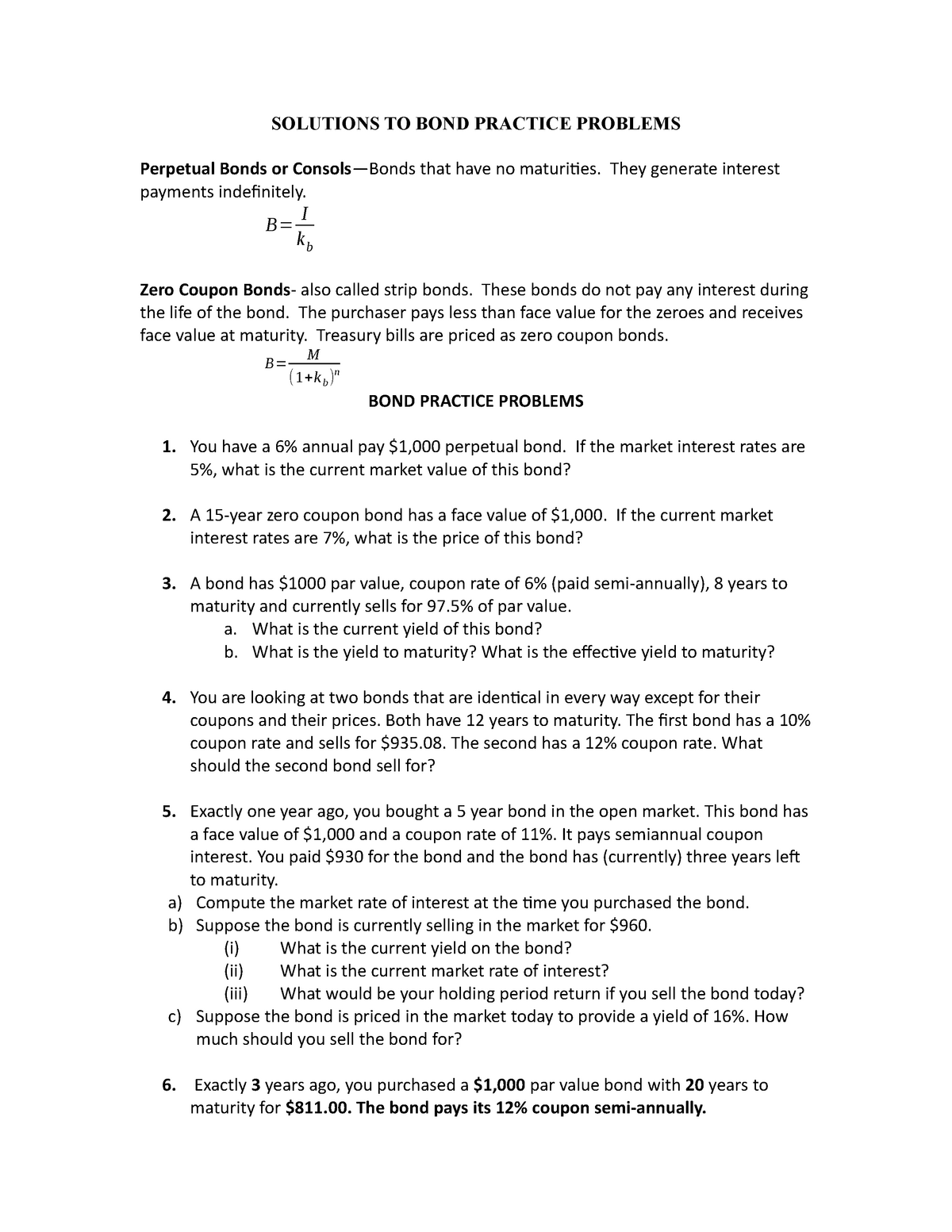

Helicopter Money and Zero Coupon Perpentual bonds PERPETUAL ZERO COUPON BONDS: A zero-coupon bond (also discount bond or deep discount bond) is a bond bought at a price lower than its face value, with the face value repaid at the time of maturity. The zero-coupon bonds do not make any interest payments (which investment professionals often refer to as the "coupon") until maturity.

Perpetual zero coupon bond

US should issue perpetual zero-coupon bonds - Breakingviews US should issue perpetual zero-coupon bonds - Breakingviews. Eikon. Information, analytics and exclusive news on financial markets - delivered in an intuitive desktop and mobile interface. Refinitiv Data Platform. Everything you need to empower your workflow and enhance your enterprise data management. World-Check. Zero-coupon perpetual bonds? - Rudhar.com The government would issue these bonds specifically for the purposes of allowing the central bank to 'balance' its sovereign money liabilities. The zero-coupon perpetual bonds would not count as part of the national debt as they have no servicing cost (i.e. no interest) for the government, and no repayment obligation. Zero-Coupon Bonds and Taxes - Investopedia Zero-coupon bonds may also appeal to investors looking to pass on wealth to their heirs. If a bond selling for $2,000 is received as a gift, it only uses $2,000 of the yearly gift tax exclusion....

Perpetual zero coupon bond. Chancellor: Zero-coupon bonds are not a joke | Reuters The column teasingly suggested that Washington should issue zero-coupon perpetual bonds, as this would reduce debt service costs. When it appeared in the Breakingviews column of the Wall Street... Secondary Bonds Market – Types of BondsIndia You can Invest in Secondary Bonds in India. Types of Bonds in India including PSU Bonds, Corporate Bonds, Tax Free Bonds, Government Security Bonds, Zero Coupons, Convertible Bonds, Sovereign Gold Bonds, Perpetual Bonds, Green Bonds, Covered Bonds, State Development Loans, Market Linked Debenture Bonds. PDF CMU CMU Bonds Home - Morningstar, Inc. Welcome to the Bond Section of the Market Data Center. This section includes general bond market information such as news, benchmark yields, and corporate bond market activity and performance information, descriptive data on U.S. Treasury, Agency, Corporate and Municipal Bonds, Credit Rating Information from major rating agencies, and price information with real-time transaction prices for ...

PDF BOLI - The "Zero Coupon Perpetual Bond" - NFP Additional features of the BOLI "zero coupon perpetual bond" are: • This bond is often purchased with as much as a 65% discount, without undue credit risk. • The maturity value is essentially guaranteed by the issuer, insurance company, without essentially any default risk. • This is all tax-free per the Internal Revenue Code! Zero-Coupon Bond - Definition, How It Works, Formula Price of bond = $1,000 / (1+0.05) 5 = $783.53 The price that John will pay for the bond today is $783.53. Example 2: Semi-annual Compounding John is looking to purchase a zero-coupon bond with a face value of $1,000 and 5 years to maturity. The interest rate on the bond is 5% compounded semi-annually. What price will John pay for the bond today? Is fiat currency the same as a perpetual zero coupon bond? Answer (1 of 4): representative money, like gold standard money, can be considered a debt in that the hold is owed that amount of gold and a bond is something one is paid an increased value on over time if with the gold standard there is still inflation, which there usually was, then as the val... Calling Bitcoin a Ponzi Scheme is Lazy Thinking | by Alvin T ... What are zero-coupon perpetual bonds? They are a type of bond that, in theory, combines the features of zero-coupon bonds and perpetual bonds. Zero-coupon bonds: Bonds that do not pay interest but are issued at a discount vs the nominal value of the bond. On maturity, the bond issuer pays back the nominal value of the bond.

All the 21 Types of Bonds | General Features and Valuation | eFM Jun 13, 2022 · It is also known as a straight bond or a bullet bond. Zero-Coupon Bonds. A zero-coupon bond is a type of bond with no coupon payments. It is not that there is no yield; the zero-coupon bonds are issued at a price lower than the face value (say 950$) and then pay the face value on maturity ($1000). The difference will be the yield for the investor. Perpetual Bonds - Overview, Issuers, Advantages, Disadvantages So, for example, assume that you invested in a perpetual bond with a par value of $1,000 by purchasing the bond at a discounted price of $950. You receive a total of $80 per year in coupon payments. Current Yield = [80 / 950] * 100 = 0.0842 * 100 = 8.42% The current yield from the bond is 8.42%. Related Readings International bonds: Odebrecht Oil & Gas Finance, 0% perp., USD ... International bonds: Odebrecht Oil & Gas Finance, 0% perp., USD USG6712EAB41 Download Copy to clipboard Perpetual, Guaranteed, Trace-eligible, Zero-coupon bonds, Senior Unsecured Status Early redeemed Amount 1,758,820,530 USD Placement *** Early redemption *** (-) ACI on No data Country of risk Brazil Current coupon - Price - Yield / Duration - Seriously, Money Is Not A Zero Coupon Perpetual - Bond Economics A perpetual bond is a bond that pays a fixed coupon on a fixed schedule (for example, annually, or semi-annually), but has no fixed maturity date. For example, we could have a perpetual bond that pays $1 on every December 1st (with the standard correction for weekends). These show up a lot in financial and economic theory, but are rare in practice.

Invest in G-SEC STRIPS India - Bondsindia.com The face value of a G-Strip Bond is Rs 1000. The bond bears a coupon rate of 9% with coupon payments being made at the end of each year. The maturity of the bond is 4 years. If the bond is redeemable at a premium of 11%. What would be the present market price of the bond?

What is the fair price of a perpetual zero-coupon bond? - Quora But then someone says, "Gotcha, a dollar (or any other modern fiat currency) is a perpetual zero-coupon bond, since it pays no interest and never redeems principal." The more thoughtful answer is that a perpetual zero-coupon bond has no discounted cash flow value, but can have transaction or some other type of value. 848 views View upvotes

Zero coupon bonds are back in flavour. Will the party continue? Sep 06, 2022 · The difference between the issue price and the maturity value of the zero coupon bond is the capital gain for the investor. ... Canara Bank to issue perpetual bonds, say traders.

Advantages and Risks of Zero Coupon Treasury Bonds - Investopedia Zero-coupon bonds are also appealing for investors who wish to pass wealth on to their heirs but are concerned about income taxes or gift taxes. If a zero-coupon bond is purchased for $1,000 and...

Perpetual Bond Definition - Investopedia Mar 19, 2020 · Perpetual Bond: A perpetual bond is a fixed income security with no maturity date . One major drawback to these types of bonds is that they are not redeemable. Given this drawback, the major ...

Zero-Coupon Bond Definition - Investopedia A zero-coupon bond, also known as an accrual bond, is a debt security that does not pay interest but instead trades at a deep discount, rendering a profit at maturity, when the bond is redeemed for...

PDF Bonds - Finance Department » Pure discount or zero-coupon bonds - Pay no coupons prior to maturity. » Coupon bonds - Pay a stated coupon at periodic intervals prior to maturity. » Floating-rate bonds - Pay a variable coupon, reset periodically to a reference rate. zBonds without a balloon payment » Perpetual bonds - Pay a stated coupon at periodic intervals.

Zero-Coupon Bonds and Taxes - Investopedia Zero-coupon bonds may also appeal to investors looking to pass on wealth to their heirs. If a bond selling for $2,000 is received as a gift, it only uses $2,000 of the yearly gift tax exclusion....

Zero-coupon perpetual bonds? - Rudhar.com The government would issue these bonds specifically for the purposes of allowing the central bank to 'balance' its sovereign money liabilities. The zero-coupon perpetual bonds would not count as part of the national debt as they have no servicing cost (i.e. no interest) for the government, and no repayment obligation.

US should issue perpetual zero-coupon bonds - Breakingviews US should issue perpetual zero-coupon bonds - Breakingviews. Eikon. Information, analytics and exclusive news on financial markets - delivered in an intuitive desktop and mobile interface. Refinitiv Data Platform. Everything you need to empower your workflow and enhance your enterprise data management. World-Check.

Post a Comment for "42 perpetual zero coupon bond"