42 zero coupon bonds definition

Zero-Coupon Bonds - Accounting Hub A zero-coupon bond is a debt instrument and it pays no periodic interest. This bond is traded at a deep discount to its face value. US treasury bills are a prime example of zero-coupon bonds. These bonds are also called discount bonds. These bonds can be issued with zero interest from the beginning. Zero Coupon Bonds - Morningstar, Inc. Zero Coupon Bonds Generally high-quality government bonds, originally issued in bearer form, where some or all of the interest coupons have been detached from the certificate.

Zero Coupon Bond - Definition - Moneychimp Zero Coupon Bond A bond that sells at a huge discount and pays no interest.

:max_bytes(150000):strip_icc():gifv()/treasurynotes-bills-and-bonds-3305609-finalv42-fc941b4ff55d4247951067ef742a406b.png)

Zero coupon bonds definition

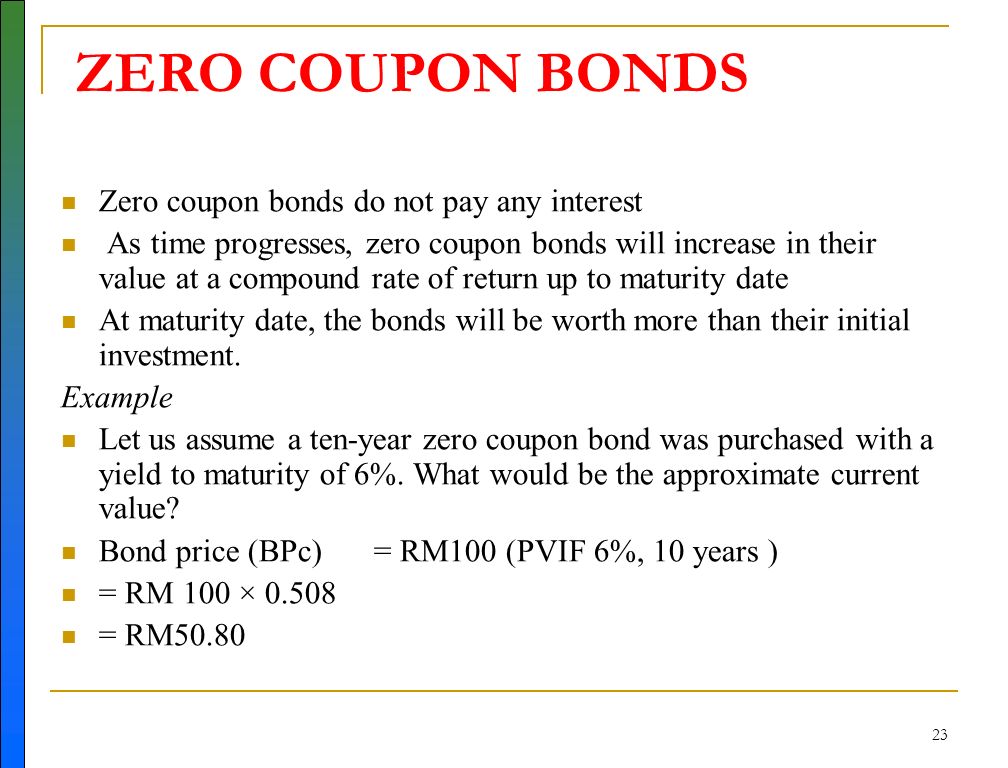

Zero-Coupon Bond - Definition, How It Works, Formula A zero-coupon bond is a bond that pays no interest. The bond trades at a discount to its face value. Reinvestment risk is not relevant for zero-coupon bonds, but interest rate risk is relevant for the bonds. Understanding Zero-Coupon Bonds As a zero-coupon bond does not pay periodic coupons, the bond trades at a discount to its face value. Zero Coupon Bond | Investor.gov Zero coupon bonds are bonds that do not pay interest during the life of the bonds. Instead, investors buy zero coupon bonds at a deep discount from their face value, which is the amount the investor will receive when the bond "matures" or comes due. Zero Coupon Bond - (Definition, Formula, Examples, Calculations) Zero-Coupon Bond (Also known as Pure Discount Bond or Accrual Bond) refers to those bonds which are issued at a discount to its par value and makes no periodic interest payment, unlike a normal coupon-bearing bond. In other words, its annual implied interest payment is included in its face value which is paid at the maturity of such bond.

Zero coupon bonds definition. Zero Coupon Bond - (Definition, Formula, Examples, Calculations) Basis Zero-Coupon Bond Regular Coupon Bearing Bond; Meaning: It refers to fixed Income Fixed Income Fixed Income refers to those investments that pay fixed interests and dividends to the investors until maturity. Government and corporate bonds are examples of fixed income investments. read more security, which is sold at a discount to its Par value and doesn’t involve … What Is a Zero-Coupon Bond? Definition, Characteristics & Example Like regular bonds, zero-coupon bonds are financial securities that mature over time, and their face (par) value is paid to their holder at the end of their term. Unlike coupon-paying bonds,... Zero-Coupon Bond - Definition, How It Works, Formula 28/01/2022 · Understanding Zero-Coupon Bonds. As a zero-coupon bond does not pay periodic coupons, the bond trades at a discount to its face value. To understand why, consider the time value of money.. The time value of money is a concept that illustrates that money is worth more now than an identical sum in the future – an investor would prefer to receive $100 today … What is a Zero-Coupon Bond? - Robinhood A zero-coupon bond is a type of debt security that trades at a discount and where the only payment occurs when the bond reaches maturity. 🤔 Understanding a zero-coupon bond Most bonds create a consistent income for the bondholder in the form of interest payments.

Zero-Coupon Bonds : What is Zero Coupon Bond? - Groww But the Zero Coupon bonds remove the reinvestment risk. Zero Coupon bonds do not allow any periodic coupon payments and thus a fixed interest on Zero Coupon bonds is assured. Fixed returns: The Zero Coupon bond is an ideal choice for those who prefer the long-term investment and earn in a lump sum. The reason behind this is the assurance of a ... Zero Coupon Bond | Definition, Formula & Examples - Study.com Feb 18, 2022 ... Adam wants to invest in a zero-coupon bond with a face value of $1,000 and 9 years to maturity. If the required interest rate on the bond is 7% ... Zero Coupon Bonds financial definition of Zero Coupon Bonds A bond that provides no periodic interest payments to its owner. A zero-coupon bond is issued at a fraction of its par value (perhaps at $3 to $5 for each $100 of face value for a long-term bond) and increases gradually in value as it approaches maturity. Thus, an investor's income from a zero-coupon bond comes solely from appreciation in value. Bond Definition: What Are Bonds? – Forbes Advisor 24/08/2021 · Zero-Coupon Bonds: As their name suggests, zero-coupon bonds do not make periodic interest payments. Instead, investors buy zero-coupon bonds at a discount to their face value and are repaid the ...

Zero coupon Definition & Meaning - Merriam-Webster zero coupon: [adjective] of, relating to, or being an investment security that is sold at a deep discount, is redeemable at face value on maturity, and that pays no periodic interest. Zero Coupon Bond: Meaning, Features & Advantages - BondsIndia A zero-coupon bond is a debt instrument wherein the issuer does not make any coupon payment but instead trades at a deep discount, rendering a profit at maturity, when the bond is redeemed for its full-face value. A zero-coupon bond will usually have higher returns than a regular bond with the same maturity because of the shape of the yield curve. Definition, Understanding, and Why zero coupon bond is Important? Sep 25, 2022 ... What is Zero Coupon Bond ... This is an accrual bond that does not pay the interest but trades at a major discount, giving a profit at maturity ... Zero-Coupon Bond Definition - Investopedia A zero-coupon bond is a debt security instrument that does not pay interest. Zero-coupon bonds trade at deep discounts, offering full face value (par) profits at maturity. The difference between...

Zero Coupon Bond Definition and Example | Investing Answers A zero coupon bond is a bond that makes no periodic interest payments and therefore is sold at a deep discount from its face value. The buyer of the bond receives a return by the gradual appreciation of the security, which is redeemed at face value on a specified maturity date.

What Is a Zero-Coupon Bond? Definition, Advantages, Risks A zero-coupon bond doesn't pay periodic interest, but instead sells at a deep discount, paying its full face value at maturity. Zeros-coupon bonds are ideal for long-term, targeted financial needs...

Learn About Zero Coupon Bond | Chegg.com Zero Coupon Bond Definition. Zero-coupon bonds are long-term investment bonds that offer no periodic interest payments and are sold at a substantial discount compared to the par value. They are also called deep discount bonds or pure discount bonds. The bondholder receives returns in the form of an increase in the value of the investment ...

Zero-Coupon Bonds: Pros and Cons - Management Study Guide Zero-coupon bonds are those bonds that are sold at a deep discount to their face value. This means that these bonds do not receive any periodic interest. Instead, the investors have to invest a lump sum amount at the beginning of their investment and get paid a higher lumpsum amount at the end of their investment.

What is a Zero-Coupon Bond? Definition, Features, Advantages ... Definition: A zero-coupon bond, as the name suggests, it is a financial instrument which does not allow a regular interest payment to the investor. Moreover, it is a bond which is issued at a meagre market price (discounted price) in comparison to its face value. And it is redeemable on or after a specified maturity date at the par value itself.

› fixed-incomeFixed Income - Definition, Securities, Instruments, Examples On the other hand, Zero-Coupon Bonds Zero-Coupon Bonds In contrast to a typical coupon-bearing bond, a zero-coupon bond (also known as a Pure Discount Bond or Accrual Bond) is a bond that is issued at a discount to its par value and does not pay periodic interest. In other words, the annual implied interest payment is included into the face ...

Section 2(48) Income Tax: Zero Coupon Bonds - CA Club a) Meaning of 'Zero Coupon Bond': Section 2 (48) Income Tax. As per Section 2 (48) of Income Tax Act, 1961, unless the context otherwise requires, the term "zero coupon bond" means a bond-. (a) issued by any infrastructure capital company or infrastructure capital fund or public sector company or scheduled bank on or after the 1st day ...

Zero-coupon bond - Wikipedia A zero coupon bond (also discount bond or deep discount bond) is a bond in which the face value is repaid at the time of maturity. Unlike regular bonds, it does not make periodic interest payments or have so-called coupons, hence the term zero-coupon bond.When the bond reaches maturity, its investor receives its par (or face) value. Examples of zero-coupon bonds include US Treasury bills, US ...

en.wikipedia.org › wiki › Warrant_(finance)Warrant (finance) - Wikipedia In finance, a warrant is a security that entitles the holder to buy or sell stock, typically the stock of the issuing company, at a fixed price called the exercise price. ...

How to Buy Zero Coupon Bonds | Finance - Zacks 1. Zero coupon bonds, also known as zeros, are distinct in that they do not make annual interest payments. The bonds are sold at a deep discount, and the principal plus accrued interest is paid at...

Fixed Income - Definition, Securities, Instruments, Examples On the other hand, Zero-Coupon Bonds Zero-Coupon Bonds In contrast to a typical coupon-bearing bond, a zero-coupon bond (also known as a Pure Discount Bond or Accrual Bond) is a bond that is issued at a discount to its par value and does not pay periodic interest. In other words, the annual implied interest payment is included into the face value of the bond, which is …

What Is a Zero-Coupon Bond? Definition, Advantages, Risks Jul 28, 2022 ... A zero-coupon bond doesn't pay periodic interest, but instead sells at a deep discount, paying its full face value at maturity. · Zeros-coupon ...

What are Bonds? definition, features and types - Business Jargons Zero Coupon Bond: The bonds which do not carry periodic interest payment is called zero coupon bond. The issuance of these bonds are made at a steep discount over its face value and repaid at face value on maturity. Deep discount bond: A type of zero interest bonds which are offered for sale at discounted value and is redeemed at face value on ...

What is a Zero Coupon Bond? - Definition | Meaning | Example A Zero coupon bond is a bond that sells without a stated rate of interest. This way the company or government doesn't have to worry about changing interest rates. These bonds are sold at a discount don't pay a standard monthly interest percentage like normal bonds do. Instead, investors receive the gain of the appreciated bond at maturity.

Zero-coupon bonds Definition - OECD Glossary of Statistical Terms Aug 29, 2003 ... - A zero-coupon bond is a leveraged investment in that a relatively small initial outlay gives exposure to a larger nominal amount. Source ...

› advisor › investingBond Definition: What Are Bonds? – Forbes Advisor Aug 24, 2021 · Zero-Coupon Bonds: As their name suggests, zero-coupon bonds do not make periodic interest payments. Instead, investors buy zero-coupon bonds at a discount to their face value and are repaid the ...

businessjargons.com › bondsWhat are Bonds? definition, features and types - Business Jargons Definition: Bonds can be defined as the negotiable instrument, issued in relation to borrowing arrangement, that indicates indebtedness.It is an unsecured debt instrument, in which the bond investor extends credit to the issuer, which in turn commits to repay the loan amount on the specified maturity date, along with interest throughout the life of the bond.

zero coupon bonds definition and meaning | AccountingCoach zero coupon bonds definition. A bond without a stated interest rate. Because no interest is paid, the bond will sell for a discount from its maturity value. Rather than receiving interest, an investor's compensation will be the difference between the discounted price at which the bond was purchased and the price the investor receives when ...

Zero-coupon bond financial definition of Zero-coupon bond A bond that provides no periodic interest payments to its owner. A zero-coupon bond is issued at a fraction of its par value (perhaps at $3 to $5 for each $100 of face value for a long-term bond) and increases gradually in value as it approaches maturity. Thus, an investor's income from a zero-coupon bond comes solely from appreciation in value.

What Is Bond Duration? Definition, Formula & Examples Zero-Coupon Bonds. The easiest duration to calculate is that of a zero-coupon bond. This bond has zero yield, which means it does not pay any interest. Its duration is equal to its time to maturity. When a coupon is added to a bond, the duration will always be less than its maturity. Short and Medium-Term Bonds

› terms › bBond Discount - Investopedia May 29, 2021 · Bond Discount: The amount by which the market price of a bond is lower than its principal amount due at maturity. This amount, called its par value , is often $1,000. As bond prices are quoted as ...

What are Zero-Coupon Bonds? (Definition, Formula, Example, Advantages ... A zero-coupon bond is a financial instrument that does not render interest. They normally trade at high discounts, and offer full face par value, at the time of maturity. The spread between the purchase price of the bond and the price that the bondholder receives at maturity is described as the profit of the bondholder.

Advantages and Risks of Zero Coupon Treasury Bonds - Investopedia Zero-coupon U.S. Treasury bonds are also known as Treasury zeros, and they often rise dramatically in price when stock prices fall. Zero-coupon U.S. Treasury bonds can move up significantly when...

Meaning of zero coupon bond in English - Cambridge Dictionary Sep 21, 2022 ... Meaning of zero coupon bond in English ... a type of bond that does not pay interest, but that you buy for less than its face value , so that you ...

The Basics Of Bonds - Investopedia 31/07/2022 · Because bonds pay a steady interest stream, called the coupon, owners of bonds have to pay regular income taxes on the funds received. For this reason, bonds are best kept in a tax sheltered ...

› the-basics-of-bondsThe Basics Of Bonds - Investopedia Jul 31, 2022 · Bonds (T-bonds) issued by the Treasury with a year or less to maturity are called “Bills”; bonds issued with 1 to 10 years to maturity are called “notes”; and bonds issued with more than ...

Bond Discount - Investopedia 29/05/2021 · Bond Discount: The amount by which the market price of a bond is lower than its principal amount due at maturity. This amount, called its par value , is often $1,000. As bond prices are quoted as ...

The One-Minute Guide to Zero Coupon Bonds | FINRA.org The One-Minute Guide to Zero Coupon Bonds Most bonds make regular interest or "coupon" payments—but not zero-coupon bonds. Zeros, as they are sometimes called, are bonds that pay no coupon or interest payment. If interest rates rise, the value of your zero-coupon bond on the secondary market will likely fall.

Zero Coupon Bond - (Definition, Formula, Examples, Calculations) Zero-Coupon Bond (Also known as Pure Discount Bond or Accrual Bond) refers to those bonds which are issued at a discount to its par value and makes no periodic interest payment, unlike a normal coupon-bearing bond. In other words, its annual implied interest payment is included in its face value which is paid at the maturity of such bond.

Zero Coupon Bond | Investor.gov Zero coupon bonds are bonds that do not pay interest during the life of the bonds. Instead, investors buy zero coupon bonds at a deep discount from their face value, which is the amount the investor will receive when the bond "matures" or comes due.

Zero-Coupon Bond - Definition, How It Works, Formula A zero-coupon bond is a bond that pays no interest. The bond trades at a discount to its face value. Reinvestment risk is not relevant for zero-coupon bonds, but interest rate risk is relevant for the bonds. Understanding Zero-Coupon Bonds As a zero-coupon bond does not pay periodic coupons, the bond trades at a discount to its face value.

:max_bytes(150000):strip_icc():gifv()/zero-couponbond_final-a6ec3618516a49c9a3654a1c79c9b681.png)

Post a Comment for "42 zero coupon bonds definition"