43 yield to maturity coupon bond

1 Find the yield to maturity on a semiannual coupon bond ... Find the yield to maturity on a semiannual coupon bond given that the bond price is $988 having at the coupon rate of 8%. The bond has a face value of$1000, and there are 25 years remaining until maturity. A)7.22% B)8.11% C)8.81% D)9.41%. 2.Find the price of a semiannual coupon bond given that the coupon rate 5%, the face value of the bond is$1000. Zero Coupon Bond Value Calculator: Calculate Price, Yield ... Calculating Yield to Maturity on a Zero-coupon Bond YTM = (M/P) 1/n - 1 variable definitions: YTM = yield to maturity, as a decimal (multiply it by 100 to convert it to percent) M = maturity value P = price n = years until maturity Let's say a zero coupon bond is issued for $500 and will pay $1,000 at maturity in 30 years.

Zero-Coupon Bond: Formula and Excel Calculator To calculate the yield-to-maturity (YTM) on a zero-coupon bond, first divide the face value (FV) of the bond by the present value (PV). The result is then raised to the power of one divided by the number of compounding periods. Zero-Coupon Bond YTM Formula Yield-to-Maturity (YTM) = (FV / PV) ^ (1 / t) - 1 Zero-Coupon Bond Risks

Yield to maturity coupon bond

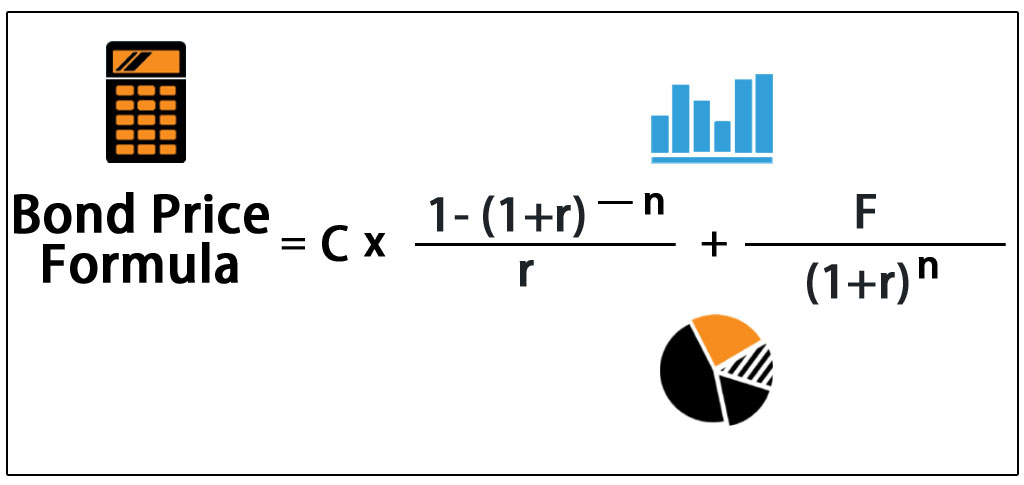

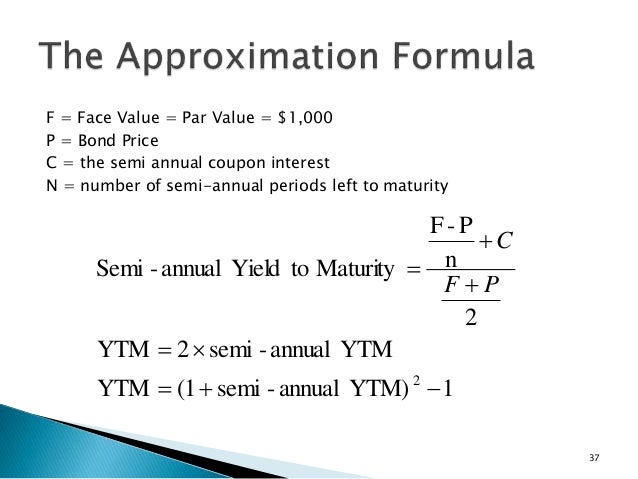

Bond Yields: Nominal and Current Yield, Yield to Maturity ... Yield to Call, Yield to Put, or Yield to Maturity Formula for Bonds that Pay Coupons Semiannually Bond Price = C 1 (1+YTM/2) 1 + ... + C n (1+YTM/2) 2n + P (1+YTM/2) 2n This equation shows that the bond price = the present value of all bond payments with the interest rate equal to the yield to maturity. Current Yield vs. Yield to Maturity - Investopedia Dec 13, 2021 · Conversely, when a bond sells for less than par, which is known as a discount bond, its current yield and YTM are higher than the coupon rate. Only on occasions when a bond sells for its exact par ... Yield to Maturity (YTM) - Definition, Formula, Calculations Use the below-given data for calculation of yield to maturity. Coupon on the bond will be $1,000 * 7.5% / 2 which is $37.50, since this pays semi-annually. Yield to Maturity (Approx) = ( 37.50 + (1000 - 1101.79) / (20 * 2) )/ ( (1000 + 1101.79) / 2) YTM will be - This is an approximate yield on maturity, which shall be 3.33%, which is semiannual.

Yield to maturity coupon bond. BAII Plus Bond Yield Calculations | TVMCalcs.com Current Yield; Yield to Maturity; Yield to Call; We will discuss each of these in turn below. In the bond valuation. The Current Yield. The current yield is a measure of the income provided by the bond as a percentage of the current price: There is no built-in function to calculate the current yield, so you must use this formula. For the ... How to calculate yield to maturity in Excel (Free Excel Template) Sep 12, 2021 · Nper = Total number of periods of the bond maturity. The years to maturity of the bond is 5 years. But coupons per year are 2. So, nper is 5 x 2 = 10. Pmt = The payment made in every period. It cannot change over the life of the bond. The coupon rate is 6%. But as payment is done twice a year, the coupon rate for a period will be 6%/2 = 3%. Yield to Maturity Calculator | Good Calculators r is the yield to maturity (YTM) of a bond, B is the par value or face value of a bond, Y is the number of years to maturity. Example 2: Suppose a bond is selling for $980, and has an annual coupon rate of 6%. It matures in five years, and the face value is $1000. What is the Yield to Maturity? Difference Between Coupon Rate And Yield Of Maturity The major difference between coupon rate and yield of maturity is that coupon rate has fixed bond tenure throughout the year. However, in the case of the yield of maturity, it changes depending on several factors like remaining years till maturity and the current price at which the bond is being traded.

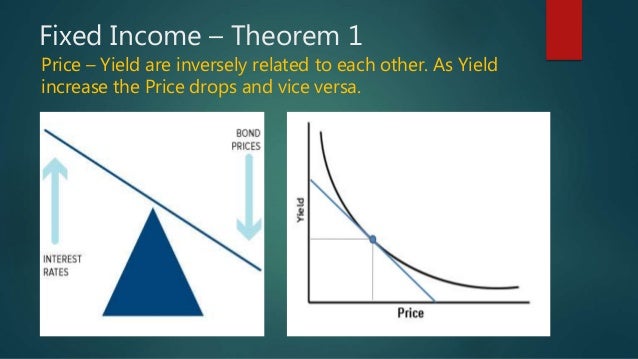

Yield to Maturity (YTM) - Meaning, Formula & Calculation Using the YTM formula, the required yield to maturity can be determined. 700 = 40/ (1+YTM)^1 + 40/ (1+YTM)^2 + 1000/ (1+YTM)^2 The Yield to Maturity (YTM) of the bond is 24.781% After one year, the YTM of the bond is 24.781% instead of 5.865%. Hence changing market conditions like inflation, interest rate changes, downgrades etc affect the YTM. Yield to Maturity vs. Coupon Rate: What's the Difference? The yield to maturity (YTM) is the percentage rate of return for a bond assuming that the investor holds the asset until its maturity date. It is the sum of all of its remaining coupon payments. A... What is Yield to Maturity (YTM)? | IIFL Knowledge Center The yield to maturity is the total return expected on a bond if held till maturity whereas, the interest rate is the amount that the issuer pays to the bondholder on an annual basis. Answered: What is the current yield of a bond… | bartleby A: Bond valuation involves five components - coupon rate, yield, present value, future value and time… question_answer Q: Division A's projects are assigned a discount rate that is 2 percent less than the firm's weighted…

Bond Yield to Maturity (YTM) Calculator - DQYDJ Yield to Maturity of Zero Coupon Bonds. A zero coupon bond is a bond which doesn't pay periodic payments, instead having only a face value (value at maturity) and a present value (current value). This makes calculating the yield to maturity of a zero coupon bond straight-forward: If the current price of a bond is equal to its face ... If the current price of a bond is equal to its face value Select one: a. the coupon rate must be greater than the yield to maturity. b. the yield to maturity must be greater than the current yield. c. the current yield must be greater than the coupon rate. d. there is no capital gain or loss from holding the bond until maturity. coupon and yield : bonds Coupon refers to the stated interest rate of the bond. A 5% coupon is $50, etc. Yield refers to the % received buying the bond and can be measured on different end-points (yield to maturity, yield to worst, etc.), and is influenced by the purchase price of the bond (if you buy below par, the yield will be higher than the coupon, if you buy ... Yield to Maturity (YTM): Formula and Excel Calculator From the perspective of a bond investor, the yield to maturity (YTM) is the anticipated total return received if the bond is held to its maturity date and all coupon payments are made on time and are then reinvested at the same interest rate. In This Article What are the steps to calculating the yield to maturity (YTM) in Excel?

Yield to Maturity - Approximate Formula (with Calculator) The price of a bond is $920 with a face value of $1000 which is the face value of many bonds. Assume that the annual coupons are $100, which is a 10% coupon rate, and that there are 10 years remaining until maturity. This example using the approximate formula would be. After solving this equation, the estimated yield to maturity is 11.25%.

Explain Bonds, Bond Terms, Price and Yield, Types of Bond Risk - Arbor Asset Allocation Model ...

Yield to Maturity (YTM) Definition & Example ... Yield to Maturity Example Let's say you're thinking about purchasing a bond that's priced at $1,000 and has a face value of $1,500. The bond will mature in 6 years and the coupon rate is 5%. To determine the YTM, we'll use the formula mentioned above: YTM = t√$1,500/$1,000 - 1 The estimated YTM for this bond is 13.220%.

Yield to Maturity (YTM) - Overview, Formula, and Importance The coupon rate Coupon Rate A coupon rate is the amount of annual interest income paid to a bondholder, based on the face value of the bond. for the bond is 15% and the bond will reach maturity in 7 years. The formula for determining approximate YTM would look like below: The approximated YTM on the bond is 18.53%. Importance of Yield to Maturity

Coupon Bond Formula | How to Calculate the Price of Coupon ... Each bond has a par value of $1,000 with a coupon rate of 8%, and it is to mature in 5 years. The effective yield to maturity is 7%. Determine the price of each C bond issued by ABC Ltd. Below is given data for the calculation of the coupon bond of ABC Ltd. Therefore, the price of each bond can be calculated using the below formula as,

Bond Yield Formula | Step by Step Calculation & Examples Bond Yield =4.875%; Here we have to saw that increase in bond prices results in the decrease in bond yield. Example #2. If a bond has a face value of $1000 and its prices $970 now and the coupon rate is 5%, find the bond yield. Face Value =$1000; Coupon Rate=5%; Bond Price = $970; Solution:

Basics Of Bonds - Maturity, Coupons And Yield To calculate the current yield for a bond with a coupon yield of 4.5 percent trading at 103 ($1,030), divide 4.5 by 103 and multiply the total by 100. You get a current yield of 4.37 percent. Say you check the bond's price later and it's trading at 101 ($1,010). The current yield has changed. Divide 4.5 by the new price, 101.

Solved What is the yield to maturity of a coupon bond ... What is the yield to maturity of a coupon bond that has annual coupon payments of $45, a face value of $1000, a price of $985, and a maturity of one year? Select one: a. 4.50% b. 1.52% c. 3.00% d. 6.09%

The yield to maturity on a bond is a below the coupon rate ... The bond's yield to maturity is below 9%. e. If the bond's yield to maturity declines, the bond price will be lower than its par value. b. If there is no change in it s yield to maturity over the next year , then the bond 's capital gains is positive . 50. A 12-year bond has an annual coupon of 9%. The bond has a yield to maturity of 7%.

Post a Comment for "43 yield to maturity coupon bond"