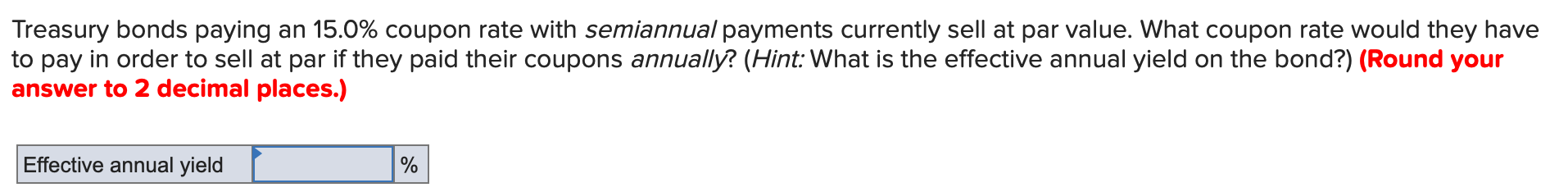

42 coupon rate for treasury bonds

Zero-Coupon Bond Definition - Investopedia 31/05/2022 · Zero-Coupon Bond: A zero-coupon bond is a debt security that doesn't pay interest (a coupon) but is traded at a deep discount, rendering profit at maturity when the bond is redeemed for its full ... Price, Yield and Rate Calculations for a Treasury Bill Calculate the ... Price, Yield and Rate Calculations for a Treasury Bill Convert Price to Discount Rate Calculate the Dollar Price for a Treasury Bill These examples are provided for illustrative purposes only and are in no way a prediction of interest rates or prices on any bills, notes or bonds issued by the Treasury. In actual practice, Treasury uses a mainframe and generally does not round prior to ...

Series I Savings Bonds Rates & Terms: Calculating Interest ... NEWS: The initial interest rate on new Series I savings bonds is 9.62 percent. You can buy I bonds at that rate through October 2022. Learn more. KEY FACTS: I ...

Coupon rate for treasury bonds

Understanding Treasury Bond Interest Rates | Bankrate Nov 2, 2021 — Imagine a 30-year U.S. Treasury Bond is paying around a 1.25 percent coupon rate. That means the bond will pay $12.50 per year for every $1,000 ... Treasury Bills vs Bonds | Top 5 Differences (with Infographics) Coupon rate Coupon Rate The coupon rate is the ROI (rate of interest) paid on the bond's face value by the bond's issuers. It determines the repayment amount made by GIS (guaranteed income security). Coupon Rate = Annualized Interest Payment / Par Value of Bond * 100% read more: T-bills do not pay any coupon. They are floated as a zero-coupon ... Treasury Bills vs Bonds | Top 5 Best Differences (With Infographics) Some investors think that Treasury Bonds are not good things to invest in because the interest rate is over 10 years and it is a very long time. T-Bills are highly liquid instruments and are very low-risk instruments. Both treasury bills vs bonds can be sold before maturity through the secondary market.

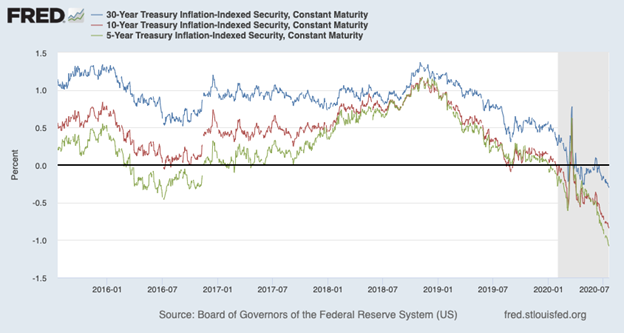

Coupon rate for treasury bonds. Bonds Center - Bonds quotes, news, screeners and educational Bonds Center - Learn the basics of bond investing, get current quotes, news, commentary and more. TreasuryDirect - Home TreasuryDirect customers: Heavy volume is slowing our response time to calls on the phone and cases sent by mail. You can call us from 8 a.m. to 5 p.m. ET, Monday through Friday. US Treasury Bonds - Fidelity US Treasury bonds: $1,000: Coupon: 20-year 30-year: Interest paid semi-annually, principal at maturity: Treasury inflation-protected securities (TIPS) $1,000: Coupon: 5-, 10-, and 30-year: Interest paid semi-annually, principal redeemed at the greater of their inflation-adjusted principal amount or the original principal amount: US Treasury floating rate notes (FRNs) $1,000: … How Is the Interest Rate on a Treasury Bond Determined? 29/08/2022 · T-bonds don't carry an interest rate as a certificate of deposit (CDs) would. Instead, a set percent of the face value of the bond is paid out at periodic intervals. This is known as the coupon rate.

Treasury Coupon Issues and Corporate Bond Yield Curves Treasury Coupon Issues Learn about the Treasury Yield Curves for Nominal and Real Coupon Issues (TNC and TRC yield curves) and The Treasury Breakeven Inflation Curve (TBI curve). Corporate Bond Yield Curve Papers and Data Learn about the corporate bond yield curve, and how it relates to the Pension Protection Act, by downloading these papers. Coupon Interest and Yield for eTBs | australiangovernmentbonds The Coupon Interest Rate on a Treasury Bond is set when the bond is first issued by the Australian Government, and remains fixed for the life of the bond. For example, a Treasury Bond with a 5% Coupon Interest Rate will pay investors $5 a year per $100 Face Value amount in instalments of $2.50 every six months. These instalments are called Coupon Interest Payments. Treasury Bills vs Bonds | Top 5 Best Differences (With Infographics) Some investors think that Treasury Bonds are not good things to invest in because the interest rate is over 10 years and it is a very long time. T-Bills are highly liquid instruments and are very low-risk instruments. Both treasury bills vs bonds can be sold before maturity through the secondary market. Treasury Bills vs Bonds | Top 5 Differences (with Infographics) Coupon rate Coupon Rate The coupon rate is the ROI (rate of interest) paid on the bond's face value by the bond's issuers. It determines the repayment amount made by GIS (guaranteed income security). Coupon Rate = Annualized Interest Payment / Par Value of Bond * 100% read more: T-bills do not pay any coupon. They are floated as a zero-coupon ...

Understanding Treasury Bond Interest Rates | Bankrate Nov 2, 2021 — Imagine a 30-year U.S. Treasury Bond is paying around a 1.25 percent coupon rate. That means the bond will pay $12.50 per year for every $1,000 ...

Post a Comment for "42 coupon rate for treasury bonds"